BrightView Reports Third Quarter Fiscal 2019 Results

BrightView Holdings, Inc. (NYSE: BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the third quarter and nine months ended June 30, 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190807005123/en/

(Graphic: Business Wire)

Third Quarter Fiscal 2019 Highlights

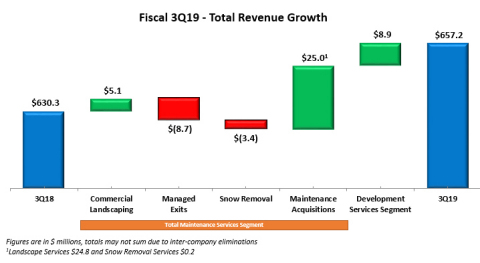

- Total Revenues for the quarter totaled $657.2 million, a 4.3% increase versus the prior year quarter, with 3.7% higher Maintenance Services Segment revenues and 5.7% higher Development Services Segment revenues;

- Net Income of $31.7 million, or $0.31 per share, and a net income margin of 4.8%, compared to Net Loss of $1.4 million, or ($0.02) per share, and a net loss margin of 0.2%, in the prior year quarter;

- Adjusted EBITDA of $101.9 million, or 4.2% growth over the prior year quarter, with an Adjusted EBITDA margin of 15.5%, representing the first time the Company delivered more than $100 million of Adjusted EBITDA in a quarter;

- Adjusted Net Income of $47.0 million, or $0.46 per share, up from Adjusted Net Income of $33.2 million, or $0.43 per share, in the prior year quarter.

Nine Months Fiscal 2019 Highlights

- Total Revenues for the nine months totaled $1,779.9 million, a 0.5% increase versus the prior year period, with 1.2% higher Maintenance Services Segment revenues and 2.1% lower Development Services Segment revenues;

- Net Income of $19.3 million, or $0.19 per share, and a net income margin of 1.1%, compared to Net Loss of $4.1 million, or ($0.05) per share, and a net loss margin of 0.2%, in the prior year period;

- Adjusted EBITDA of $213.1 million, or 1.3% below the prior year period, with an Adjusted EBITDA margin of 12.0%;

- Adjusted Net Income of $73.1 million, or $0.71 per share, up from Adjusted Net Income of $54.1 million, or $0.70 per share, in the prior year period.

“Today we are reporting the highest quarterly revenue and adjusted EBITDA results in BrightView’s history. Our Maintenance Services Segment increased its base contract revenue, demonstrating that we are pursuing the right strategy to build a strong foundation for sustainable, future organic growth. Our Development Services Segment capitalized on a robust book of business to deliver meaningful growth in both revenue and profitability, despite the challenging wet weather conditions faced by both segments throughout the quarter and across much of the country,” said Andrew Masterman, BrightView President and Chief Executive Officer. “Moving forward, we will continue to invest in generating profitable, long-term growth. Results in our existing business are starting to show the benefits of our reorganized sales team and the initiatives we’ve implemented to “digitize” the Company by leveraging technology. Finally, our M&A pipeline remains attractive as we continue driving growth through our strong-on-strong acquisition strategy.”

Unless indicated otherwise, the information in this release has been adjusted to give effect to a 2.33839-for-one reverse stock split of the Company’s common stock effected on June 8, 2018. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Free Cash Flow and Adjusted Earnings per Share are non-GAAP measures. Refer to the “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” sections for more information.

Fiscal 2019 Results – Total BrightView

|

Total BrightView - Operating Highlights |

||||||||||||||||||||

|

|

|

Three Months Ended June 30, |

|

Nine Months Ended June 30, |

||||||||||||||||

|

($ in millions, except per share figures) |

|

2019 |

|

|

2018 |

|

|

Change |

|

2019 |

|

|

2018 |

|

|

Change |

||||

|

Revenue |

|

$ |

657.2 |

|

|

$ |

630.3 |

|

|

4.3% |

|

$ |

1,779.9 |

|

|

$ |

1,771.8 |

|

|

0.5% |

|

Net income (loss) |

|

$ |

31.7 |

|

|

$ |

(1.4 |

) |

|

nm |

|

$ |

19.3 |

|

|

$ |

(4.1 |

) |

|

nm |

|

Adjusted EBITDA |

|

$ |

101.9 |

|

|

$ |

97.8 |

|

|

4.2% |

|

$ |

213.1 |

|

|

$ |

215.9 |

|

|

(1.3%) |

|

Adjusted EBITDA Margin |

|

|

15.5 |

% |

|

|

15.5 |

% |

|

0 bps |

|

|

12.0 |

% |

|

|

12.2 |

% |

|

-20 bps |

|

Adjusted Net Income |

|

$ |

47.0 |

|

|

$ |

33.2 |

|

|

41.6% |

|

$ |

73.1 |

|

|

$ |

54.1 |

|

|

35.1% |

|

Earnings per Share, GAAP |

|

$ |

0.31 |

|

|

$ |

(0.02 |

) |

|

nm |

|

$ |

0.19 |

|

|

$ |

(0.05 |

) |

|

nm |

|

Earnings per Share, Adjusted |

|

$ |

0.46 |

|

|

$ |

0.43 |

|

|

7.0% |

|

$ |

0.71 |

|

|

$ |

0.70 |

|

|

1.4% |

|

Weighted average number of common shares outstanding |

|

|

102.8 |

|

|

|

77.0 |

|

|

33.5% |

|

|

102.7 |

|

|

|

77.0 |

|

|

33.3% |

For the third quarter fiscal 2019, total revenue increased 4.3% to $657.2 million due to increases in both the Maintenance Services Segment and Development Services Segment revenues. Total Adjusted EBITDA increased 4.2% driven by an increase in the Development Services Segment Adjusted EBITDA, and included relatively flat Maintenance Services Segment Adjusted EBITDA, as discussed further below, partially offset by higher corporate expenses.

For the nine months ended June 30, 2019, total revenue increased 0.5% to $1,779.9 million due to an increase in Maintenance Services Segment revenue, partially offset by a decline in Development Services Segment revenue. Total Adjusted EBITDA was $213.1 million, down 1.3% versus the prior year, driven by a decrease in Maintenance Services Segment together with relatively flat Development Services Segment Adjusted EBITDA, partially offset by lower corporate expenses.

Fiscal 2019 Results – Segments

|

Maintenance Services - Operating Highlights |

|||||||||||||||||||||||

|

|

|

Three Months Ended June 30, |

|

|

Nine Months Ended June 30, |

||||||||||||||||||

|

($ in millions) |

|

2019 |

|

|

2018 |

|

|

Change |

|

|

2019 |

|

|

2018 |

|

|

Change |

||||||

|

Landscape Maintenance |

|

$ |

486.4 |

|

|

$ |

465.7 |

|

|

4.4% |

|

|

$ |

1,112.6 |

|

|

$ |

1,088.8 |

|

|

2.2% |

||

|

Snow Removal |

|

$ |

5.7 |

|

|

$ |

8.9 |

|

|

(36.6%) |

|

|

$ |

245.4 |

|

|

$ |

252.6 |

|

|

(2.9%) |

||

|

Total Revenue |

|

$ |

492.1 |

|

|

$ |

474.6 |

|

|

3.7% |

|

|

$ |

1,358.0 |

|

|

$ |

1,341.4 |

|

|

1.2% |

||

|

Adjusted EBITDA |

|

$ |

91.1 |

|

|

$ |

91.3 |

|

|

(0.2%) |

|

|

$ |

204.8 |

|

|

$ |

210.2 |

|

|

(2.6%) |

||

|

Adjusted EBITDA Margin |

|

|

18.5 |

% |

|

|

19.2 |

% |

|

-70 bps |

|

|

|

15.1 |

% |

|

|

15.7 |

% |

|

-60 bps |

||

|

Capital Expenditures |

|

$ |

24.4 |

|

|

$ |

14.3 |

|

|

71.0% |

|

|

$ |

54.4 |

|

|

$ |

33.8 |

|

|

61.3% |

||

For the third quarter fiscal 2019, revenue in the Maintenance Services Segment increased 3.7% to $492.1 million. Landscape Maintenance revenue increased 4.4%. Acquisitions added 5.3% but were partially offset by a 0.9% negative revenue contribution from commercial landscaping, including lower revenue due to Managed Exits as the Company strategically reduced a number of less profitable accounts established in previous years. Excluding Managed Exits, the Company’s commercial landscaping revenue grew 1.0% versus the prior-year quarter with contract growth more than offsetting softness in ancillary services revenue related to weather. Snow removal revenue, which included a small contribution from acquired companies, decreased 36.6% versus the unusually high level of snowfall in the prior-year quarter.

Adjusted EBITDA for the Maintenance Services Segment in the quarter remained relatively flat at $91.1 million, with the Adjusted EBITDA margin decreasing 70 basis points versus the prior year quarter. The decrease in segment profitability was due to unfavorable weather conditions resulting in lower margins on ancillary services and decreased efficiencies in core commercial landscaping services, coupled with an increase in selling, general and administrative expenses as a result of the absorption of acquired businesses, partially offset by the increase in revenue described above.

For the nine months ended June 30, 2019, revenue in the Maintenance Services Segment increased 1.2% to $1,358.0 million. Landscape Maintenance revenue increased 2.2%. Acquisitions added 6.4% but were mostly offset by a 4.2% negative revenue contribution from commercial landscaping, including a difficult comparison with the revenue related to Hurricane Irma and Maria clean-up, and lower revenue due to Managed Exits as the Company strategically reduced the number of less profitable accounts established in previous years. Snow removal revenue decreased 2.9% due to lower year-over-year snowfall in key geographies, especially during the first and third quarters of fiscal 2019.

Adjusted EBITDA for the Maintenance Services Segment for the nine months ended June 30, 2019 decreased 2.6% to $204.8 million, with the Adjusted EBITDA margin decreasing 60 basis points versus the prior year period. The decline in segment profitability was mainly a result of the comparison with higher-margin hurricane clean-up activity in the first quarter of fiscal 2018 and unfavorable weather conditions resulting in lower margins on snow removal services during the first quarter compared to the prior year quarter as well as on both ancillary and core commercial landscaping services during the third quarter compared to the prior year quarter.

|

Development Services - Operating Highlights |

|||||||||||||||||||||||

|

|

|

Three Months Ended June 30, |

|

|

Nine Months Ended June 30, |

||||||||||||||||||

|

($ in millions) |

|

2019 |

|

|

2018 |

|

|

Change |

|

|

2019 |

|

|

2018 |

|

|

Change |

||||||

|

Revenue |

|

$ |

166.3 |

|

|

$ |

157.4 |

|

|

5.7% |

|

|

$ |

424.7 |

|

|

$ |

433.6 |

|

|

(2.1%) |

||

|

Adjusted EBITDA |

|

$ |

27.0 |

|

|

$ |

22.0 |

|

|

22.8% |

|

|

$ |

55.0 |

|

|

$ |

55.3 |

|

|

(0.5%) |

||

|

Adjusted EBITDA Margin |

|

|

16.2 |

% |

|

|

14.0 |

% |

|

220 bps |

|

|

|

13.0 |

% |

|

|

12.8 |

% |

|

20 bps |

||

|

Capital Expenditures |

|

$ |

6.9 |

|

|

$ |

2.2 |

|

|

218.1% |

|

|

$ |

9.9 |

|

|

$ |

4.0 |

|

|

150.4% |

||

Revenues for the Development Services Segment increased 5.7% to $166.3 million for the third quarter fiscal 2019. Project revenue derived from the segment’s strong project pipeline coupled with revenue from acquisitions more than offset a challenging comparison with the timing of work performed on certain large projects during the prior year period.

Adjusted EBITDA for the Development Services Segment increased 22.8% to $27.0 million in the quarter, positively affected by the increase in net revenue described above, as well as a decrease in cost of services provided as the result of lower material costs as a percentage of revenue.

Revenues for the Development Services Segment decreased 2.1% to $424.7 million for the nine months ended June 30, 2019. Project revenue derived from acquisitions partially offset a challenging comparison with revenues generated from work performed on certain large projects in the prior year period.

Adjusted EBITDA for the Development Services Segment decreased 0.5% to $55.0 million during the nine months ended June 30, 2019, negatively affected by the decrease in net revenue described above, as well as an increase in selling, general and administrative expense. These changes were substantially offset by a decrease in cost of services provided as the result of lower material costs and decreased use of subcontractors.

|

Total BrightView Cash Flow Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended June 30, |

|||||||||

|

($ in millions) |

|

2019 |

|

|

2018 |

|

|

Change |

|||

|

Cash Provided by Operating Activities |

|

$ |

109.2 |

|

|

$ |

123.7 |

|

|

(11.7%) |

|

|

Adjusted Free Cash Flow |

|

$ |

38.8 |

|

|

$ |

77.5 |

|

|

(49.9%) |

|

|

Capital Expenditures |

|

$ |

77.2 |

|

|

$ |

71.7 |

|

|

7.6% |

|

Net cash provided by operating activities for the nine months ended June 30, 2019 was $109.2 million, compared to $123.7 million for the prior year. The decrease was primarily due to an increase in accounts receivable due to timing of collections coupled with a decrease in deferred revenue, partially offset by a decrease in prepaid income taxes. Adjusted Free Cash Flow for the nine months ended June 30, 2019 was $38.8 million, a decrease in cash generation of $38.7 million versus the prior year. The decrease is reflective of the decrease in net cash provided by operating activities of $14.5 million as well as an increase in capital expenditures of $27.1 million (exclusive of the fiscal 2018 purchase of legacy ValleyCrest facilities of $21.6 million).

For the nine months ended June 30, 2019, capital expenditures were $77.2 million, compared with $71.7 million last year. The prior year period included the aforementioned purchase of legacy ValleyCrest facilities. The Company also generated proceeds from the sale of property and equipment of $6.8 million and $3.9 million in the first nine months of fiscal 2019 and 2018, respectively. Net of the legacy asset purchase and the proceeds from the sale of property and equipment in each year, net capital expenditures represented 4.0% and 2.6% of revenue in the first nine months of fiscal 2019 and 2018, respectively.

|

Total BrightView Balance Sheet Metrics |

|

|

|

|

|||||||

|

($ in millions) |

|

June 30, |

|

|

March 31, |

|

|

September |

|||

|

Total Financial Debt1 |

|

$ |

1,181.5 |

|

|

$ |

1,185.3 |

|

|

$ |

1,184.4 |

|

Total Cash & Equivalents |

|

$ |

10.9 |

|

|

$ |

11.2 |

|

|

$ |

35.2 |

|

Total Net Financial Debt2 to Adjusted EBITDA ratio |

|

3.9x |

|

|

4.0x |

|

|

3.8x |

|||

|

1Total Financial Debt includes total long-term debt, net of original issue discount, and capital lease obligations |

|||||||||||

|

2Total Net Financial Debt equals Total Financial Debt minus Total Cash & Equivalents |

|||||||||||

As of June 30, 2019, the Company’s Total Net Financial Debt was $1.171 billion, a decrease of $3.5 million compared to $1.174 billion as of March 31, 2019. The Company’s Total Net Financial Debt to Adjusted EBITDA ratio was 3.9x as of June 30, 2019, compared with 4.0x as of March 31, 2019.

Recent Developments

Acquisition of Commercial Landscaping Companies from FirstService Residential

On May 28, 2019, BrightView announced the acquisition of Luke’s Landscaping, Inc. (“Luke’s”) and Desert Classic Landscaping (“Desert Classic”), both previously owned and operated by FirstService Residential, a subsidiary of FirstService Corporation (TSX: FSV; NASDAQ: FSV).

Both Luke’s and Desert Classic are leading, single-source, year-round landscape service providers, offering a full suite of commercial landscaping solutions, including grounds management, landscape enhancement, irrigation, spray and arbor services. Luke’s was founded more than 40 years ago and currently operates two branches in South Florida with nearly 250 employees, serving customers between Coral Springs and Miami. Desert Classic was established in 2002 and currently operates two branches with more than 250 employees serving customers across the entire valley area of Phoenix, Ariz.

Conference Call Information

A conference call to discuss the third quarter fiscal 2019 financial results is scheduled for August 7, 2019, at 10 a.m. Eastern Daylight Time. The U.S. toll free dial-in for the conference call is (877) 273-7124 and the international dial-in is (647) 689-5396. The conference passcode is 7495636. A live audio webcast of the conference call will be available on the Company’s investor website https://investor.brightview.com, where presentation materials will be posted prior to the call.

A telephone replay will be available shortly after the broadcast through August 14, 2019, by dialing 800-585-8367 from the U.S., and entering conference passcode 7495636. A replay of the audio webcast also will be archived on the Company’s investor website.

About BrightView:

BrightView (NYSE: BV), the nation’s largest commercial landscaper, proudly designs, creates, and maintains the best landscapes on Earth and provides the most efficient and comprehensive snow and ice removal services. With a dependable service commitment, BrightView brings brilliant landscapes to life at premier properties across the United States, including business parks and corporate offices, homeowners' associations, healthcare facilities, educational institutions, retail centers, resorts and theme parks, municipalities, golf courses, and sports venues. BrightView also serves as the Official Field Consultant to Major League Baseball. Through industry-leading best practices and sustainable solutions, BrightView is invested in taking care of our team members, engaging our clients, inspiring our communities, and preserving our planet. Visit www.BrightView.com and connect with us on X, Facebook, and LinkedIn.

For more information and/or permission to use BrightView images and assets, please send all media inquiries to [email protected]