BrightView Reports First Quarter Fiscal 2021 Results

BrightView Holdings, Inc. (NYSE: BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the first quarter ended December 31, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210204005425/en/

(Graphic: Business Wire)

“We are very pleased with the strong start to fiscal year 2021. Despite continued COVID-19 headwinds, our first quarter results reflect solid contract-based business and Adjusted EBITDA growth combined with meaningful margin expansion versus the prior year, a testament to the investments made in our expanded sales teams and sales enablement technologies, and the ongoing leverage of our technology and productivity initiatives”, said Andrew Masterman, BrightView President and Chief Executive Officer. “Our team continues to do an incredible job responding to the COVID-19 crisis by prioritizing health and safety, focusing on client relationships, and by delivering solid results in a challenging operating environment. The consistency and resiliency of our model continues to reflect fundamental strengths. Coupled with ongoing execution of our M&A strategy, we remain confident in our ability to create value.”

First Quarter Fiscal 2021 Highlights

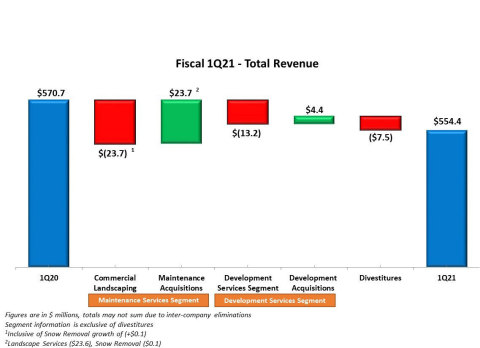

- Total revenue of $554.4 million compared to the prior year of $570.7 million.

- Maintenance revenue of $418.0 million compared to the prior year of $418.9 million;

- Land revenue of $362.2 million compared to the prior year of $363.3 million;

- Snow revenue of $55.8 million compared to the prior year of $55.6 million.

- Development revenue of $137.4 million compared to the prior year of $152.8 million.

- Net Loss of $12.0 million, or $(0.11) per share, compared to Net Loss of $12.6 million, or $(0.12) per share in the prior year; Net Loss Margin of 2.2%, flat to the prior year.

- Adjusted EBITDA of $52.4 million, an increase of $0.7 million or 1.4% compared to Adjusted EBITDA of $51.7 million in the prior year; Adjusted EBITDA margin of 9.5%, an increase of 40 basis points compared to Adjusted EBITDA margin of 9.1% in the prior year.

- Net cash provided by operating activities of $5.1 million compared to $7.3 million in the prior year.

1 Adjusted EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Financial Measures” section for more information. The Company is not providing a quantitative reconciliation of its financial outlook for Adjusted EBITDA to net income (loss), its corresponding GAAP measure, because the GAAP measure that is excluded from its non-GAAP financial outlook is difficult to reliably predict or estimate without unreasonable effort due to its dependence on future uncertainties, such as items discussed below. Additionally, information that is currently not available to the Company could have a potentially unpredictable and potentially significant impact on its future GAAP financial results.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Free Cash Flow and Adjusted Earnings per Share are non-GAAP measures. Refer to the “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” sections for more information.

Fiscal 2021 Results – Total BrightView

|

Total BrightView - Operating Highlights |

|||||||||||

|

|

|

Three Months Ended December 31, |

|||||||||

|

($ in millions, except per share figures) |

|

2020 |

|

|

2019 |

|

|

Change |

|||

|

Revenue |

|

$ |

554.4 |

|

|

$ |

570.7 |

|

|

(2.9%) |

|

|

Net Loss |

|

$ |

(12.0 |

) |

|

$ |

(12.6 |

) |

|

(4.8%) |

|

|

Net Loss Margin |

|

|

(2.2 |

%) |

|

|

(2.2 |

%) |

|

— |

|

|

Adjusted EBITDA |

|

$ |

52.4 |

|

|

$ |

51.7 |

|

|

1.4% |

|

|

Adjusted EBITDA Margin |

|

|

9.5 |

% |

|

|

9.1 |

% |

|

40 bps |

|

|

Adjusted Net Income |

|

$ |

12.9 |

|

|

$ |

10.6 |

|

|

21.7% |

|

|

Loss per Share, GAAP |

|

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

|

8.3% |

|

|

Earnings per Share, Adjusted |

|

$ |

0.12 |

|

|

$ |

0.10 |

|

|

20.0% |

|

|

Weighted average number of common shares outstanding |

|

|

105.1 |

|

|

|

103.3 |

|

|

1.7% |

|

For the first quarter of fiscal 2021, total revenue decreased 2.9% to $554.4 million driven principally by a decrease in Development Services revenues of $15.4 million. Net Loss was $12.0 million compared to Net Loss of $12.6 million in the prior year period. Total Adjusted EBITDA increased $0.7 million, or 1.4%, to $52.4 million from $51.7 million in the prior year period. Maintenance Services Segment Adjusted EBITDA increased $1.9 million, or 4.0%, to $49.6 million compared to $47.7 in the prior year period, principally driven by targeted cost containment actions and leveraging our technology initiatives. Development Services Segment Adjusted EBITDA decreased to $17.1 million from $19.1 million in the prior year period due principally to a decrease in net service revenues. The Segment Adjusted EBITDA results are discussed further below.

Fiscal 2021 Results – Segments

|

Maintenance Services - Operating Highlights |

||||||||||

|

|

|

Three Months Ended December 31, |

||||||||

|

($ in millions) |

|

2020 |

|

|

2019 |

|

|

Change |

||

|

Landscape Maintenance |

|

$ |

362.2 |

|

|

$ |

363.3 |

|

|

(0.3%) |

|

Snow Removal |

|

$ |

55.8 |

|

|

$ |

55.6 |

|

|

0.4% |

|

Total Revenue |

|

$ |

418.0 |

|

|

$ |

418.9 |

|

|

(0.2%) |

|

Adjusted EBITDA |

|

$ |

49.6 |

|

|

$ |

47.7 |

|

|

4.0% |

|

Adjusted EBITDA Margin |

|

|

11.9 |

% |

|

|

11.4 |

% |

|

50 bps |

|

Capital Expenditures |

|

$ |

8.9 |

|

|

$ |

11.7 |

|

|

(23.9%) |

For the first quarter of fiscal 2021, revenue in the Maintenance Services Segment was flat to the prior year excluding divestitures of $0.9 million. Revenues from commercial landscaping decreased $23.7 million over the 2019 period inclusive of snow, primarily due to a reduction in demand for ancillary services as a result of the COVID-19 pandemic, which was fully offset by a $23.7 million revenue contribution from acquired businesses inclusive of snow.

Adjusted EBITDA for the Maintenance Services Segment increased 4.0% to $49.6 million, from $47.7 million in the 2019 period. Additionally, Segment Adjusted EBITDA Margin increased 50 basis points, to 11.9% from 11.4% in the 2019 period. The increases in Segment Adjusted EBITDA and Segment Adjusted EBITDA Margin were principally driven by targeted cost containment actions and leveraging our technology initiatives.

|

Development Services - Operating Highlights |

||||||||||

|

|

|

Three Months Ended December 31, |

||||||||

|

($ in millions) |

|

2020 |

|

|

2019 |

|

|

Change |

||

|

Revenue |

|

$ |

137.4 |

|

|

$ |

152.8 |

|

|

(10.1%) |

|

Adjusted EBITDA |

|

$ |

17.1 |

|

|

$ |

19.1 |

|

|

(10.5%) |

|

Adjusted EBITDA Margin |

|

|

12.4 |

% |

|

|

12.5 |

% |

|

(10) bps |

|

Capital Expenditures |

|

$ |

0.3 |

|

|

$ |

2.0 |

|

|

(85.0%) |

For the first quarter of fiscal 2021, revenue in the Development Services Segment decreased 6.0% excluding divestitures of $6.6 million, principally driven by a $13.2 million reduction due to the COVID-19 pandemic, partially offset by a $4.4 million revenue contribution from acquired businesses.

Adjusted EBITDA for the Development Services Segment decreased to $17.1 million in the quarter compared to $19.1 million in the prior year period due to the decrease in net service revenues described above. In addition, approximately half of the decline was attributable to the sale of BrightView Tree Company. Segment Adjusted EBITDA Margin was relatively flat at 12.4% for the quarter versus 12.5% in the 2019 period.

|

Total BrightView Cash Flow Metrics |

||||||||||

|

|

|

Three Months Ended December 31, |

||||||||

|

($ in millions) |

|

2020 |

|

|

2019 |

|

|

Change |

||

|

Net Cash Provided by Operating Activities |

|

$ |

5.1 |

|

|

$ |

7.3 |

|

|

(30.1%) |

|

Free Cash Flow |

|

$ |

(4.0 |

) |

|

$ |

(6.2 |

) |

|

35.5% |

|

Capital Expenditures |

|

$ |

9.7 |

|

|

$ |

14.5 |

|

|

(33.1%) |

Net cash provided by operating activities for the quarter ended December 31, 2020 was $5.1 million, compared to $7.3 million for the prior year. This decrease was primarily due to an increase in cash used by accounts payable and other operating liabilities offset by a decrease in cash used by accounts receivable and other operating assets.

Free Cash Flow for the quarter ended December 31, 2020 was $(4.0) million, an increase of $2.2 million versus the prior year. The increase in Free Cash Flow was due primarily to a decline in capital expenditures of $4.8 million, described further below, partially offset by the decrease in cash flows from operating activities described above.

For the quarter ended December 31, 2020, capital expenditures were $9.7 million, compared with $14.5 million in the prior year. The Company also generated proceeds from the sale of property and equipment of $0.6 million and $1.0 million in the first quarter of fiscal 2021 and 2020, respectively. Net of the proceeds from the sale of property and equipment in the quarter, net capital expenditures represented 1.6% and 2.4% of revenue in the first quarter of fiscal 2021 and 2020, respectively.

|

Total BrightView Balance Sheet Metrics |

|||||||||||

|

($ in millions) |

|

December 31, 2020 |

|

|

December 31, 2019 |

|

|

September 30, 2020 |

|||

|

Total Financial Debt1 |

|

$ |

1,169.6 |

|

|

$ |

1,165.4 |

|

|

$ |

1,172.3 |

|

Total Cash & Equivalents |

|

|

81.6 |

|

|

|

10.3 |

|

|

|

157.1 |

|

Total Net Financial Debt2 |

|

$ |

1,088.0 |

|

|

$ |

1,155.1 |

|

|

$ |

1,015.2 |

|

Total Net Financial Debt to Adjusted EBITDA ratio3 |

|

4.0x |

|

|

3.8x |

|

|

3.7x |

|||

|

1Total Financial Debt includes total long-term debt, net of original issue discount, and finance lease obligations |

|

2Total Net Financial Debt equals Total Financial Debt minus Total Cash & Equivalents |

|

3Total Net Financial Debt to Adjusted EBITDA ratio equals Total Net Financial Debt divided by the trailing twelve month Adjusted EBITDA. |

As of December 31, 2020, the Company’s Total Net Financial Debt was $1,088.0 million, a decrease of $67.1 million compared to $1,155.1 million as of December 31, 2019. The Company’s Total Net Financial Debt to Adjusted EBITDA ratio was 4.0x and 3.8x as of December 31, 2020 and December 31, 2019, respectively.

Recent M&A Activity

In October 2020, BrightView acquired Commercial Tree Care, Inc. (CTC), a full-service tree care company based in San Jose, Calif. Founded in 1992, CTC is a full-service tree care provider specializing in pruning, tree removal, stump grinding, cabling, bracing, fertility treatment, pest and disease control, install and transplant, forestry fire fighting and timber harvesting. CTC also consults for development, appraisal, maintenance plans and overall site evaluation.

Additionally, in October 2020, BrightView acquired Water, Land, Environment, LLC (WLE), a commercial landscape maintenance and development company headquartered in Austin, Texas. Founded in 2003, WLE is a full-service commercial landscape management company, whose 250-member team serves HOA, developer, commercial, and municipal clients across three markets in Central Texas.

In December 2020, BrightView acquired Cutting Edge Property Maintenance, one of the leading commercial outdoor maintenance services providers in the Minneapolis-St. Paul region. Cutting Edge provides winter services, landscape maintenance and enhancements, tree care, and irrigation services in the Upper Midwest market.

In January 2021, BrightView acquired Green Image, LLC (d/b/a GTI) based in Las Vegas. GTI excels in multiple verticals, including maintenance and installation projects for municipalities, HOAs, tree care and irrigation.

COVID-19 Update

- Throughout the entire country, landscape maintenance continues to be recognized as an essential service.

- All branches are operational with no limitations on the scope of services we can provide.

- Executed downturn playbook and are continuing to exercise prudence, limiting discretionary spending, and managing capital expenditures and working capital.

- Prioritizing additional actions to protect revenue and margins, and preserve cash in the event of a continued and prolonged resurgence.

- Specific Health and Safety actions include:

- Proactively communicating critical information from CDC to employees.

- Implemented branch based social distancing and hygiene and sanitization procedures.

- Continuing to prohibit non-essential travel and mandated work from home policies as applicable.

- Adhering to state and local mandates and guidelines.

- Tracking current and potential exposures, imposing quarantine measures, and assigning case workers.

- Implemented protocols requiring face coverings.

Conference Call Information

A conference call to discuss the first quarter fiscal 2021 financial results is scheduled for February 4, 2021, at 10 a.m. EST. The U.S. toll free dial-in for the conference call is (877) 273-7124 and the international dial-in is (647) 689-5396. The conference passcode is 4778096. A live audio webcast of the conference call will be available on the Company’s investor website, where presentation materials will be posted prior to the call.

A replay of the call will be available from 1 p.m. EST on February 4, 2021 to 11:59 p.m. EST on February 11, 2021. To access the recording, dial (800) 585-8367 or (416) 621-4642 (Conference ID 4778096).

Forward Looking Statements

This press release contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation, including statements relating to our first quarter fiscal 2021 guidance and other statements related to our expectations regarding our industry, strategy, future operations, future liquidity and financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words such as “outlook,” “guidance,” “projects,” “continues,” “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates,” or “anticipates,” or the negative version of these words or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. Factors that could cause actual results to differ materially from those projected include, but are not limited to: general business economic and financial conditions; the duration and extent of the novel coronavirus (COVID-19) pandemic and its resurgence, and the impact of federal, state and local governmental actions and customer behavior in response to the pandemic, including possible additional or reinstated restrictions as a result of a resurgence of the pandemic; competitive industry pressures; the failure to retain current customers, renew existing customer contracts and obtain new customer contracts; the failure to enter into profitable contracts, or maintaining customer contracts that are unprofitable; a determination by customers to reduce their outsourcing or use of preferred vendors; the dispersed nature of our operating structure; our ability to implement our business strategies and achieve our growth objectives; acquisition and integration risks; the seasonal nature of our landscape maintenance services; our dependence on weather conditions; increases in prices for raw materials and fuel; changes in our ability to source adequate supplies and materials in a timely manner; any failure to accurately estimate the overall risk, requirements, or costs when we bid on or negotiate contracts that are ultimately awarded to us; the conditions and periodic fluctuations of real estate markets, including residential and commercial construction; our ability to retain our executive management and other key personnel; our ability to attract and retain trained workers and third-party contractors and re-employ seasonal workers; any failure to properly verify employment eligibility of our employees; subcontractors taking actions that harm our business; our recognition of future additional impairment charges; laws and governmental regulations, including those relating to employees, wage and hour, immigration, human health and safety and transportation; environmental, health and safety laws and regulations, including regulatory costs, claims and litigation related to the use of chemicals and pesticides by employees and related third-party claims; the distraction and impact caused by litigation, of adverse litigation judgments and settlements resulting from legal proceedings; increase in on-job accidents involving employees; any failure, inadequacy, interruption, security failure or breach of our information technology systems; our ability to adequately protect our intellectual property; restrictions imposed by our debt agreements that limit our flexibility in operating our business; our ability to generate sufficient cash flow to satisfy our significant debt service obligations; our ability to obtain additional financing to fund future working capital, capital expenditures, investments or acquisitions, or other general corporate requirements; increases in interest rates governing our variable rate indebtedness increasing the cost of servicing our substantial indebtedness including proposed changes to LIBOR; ownership of our common stock; occurrence of natural disasters, terrorist attacks or other external events; changes in generally accepted accounting principles in the United States; and costs and requirements imposed as a result of maintaining the requirement of being a public company. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under “Item 1A. Risk Factors” in our Form 10-K for the fiscal year ended September 30, 2020 as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings with the SEC. Any forward-looking statement made in this press release speaks only as of the date on which it was made. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Non-GAAP Financial Measures

To supplement the Company’s financial information presented in accordance with GAAP and aid understanding of the Company’s business performance, the Company uses certain non-GAAP financial measures, namely “Adjusted EBITDA”, “Adjusted EBITDA Margin”, “Adjusted Net Income”, “Adjusted Earnings per Share”, “Free Cash Flow”, Total Financial Debt”, “Total Net Financial Debt” and “Total Net Financial Debt to Adjusted EBITDA ratio”. We believe Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Earnings per Share, Free Cash Flow, Total Financial Debt, Total Net Financial Debt, and Total Net Financial Debt to Adjusted EBITDA ratio assist investors and in comparing our results across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management believes these non-GAAP financial measures are useful to investors in highlighting trends in our operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Management regularly uses these measures as tools in evaluating our operating performance, financial performance and liquidity. Management uses Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Earnings per Share, Free Cash Flow, Total Financial Debt, Total Net Financial Debt, and Total Net Financial Debt to Adjusted EBITDA ratio to supplement comparable GAAP measures in the evaluation of the effectiveness of our business strategies, to make budgeting decisions, to establish discretionary annual incentive compensation and to compare our performance against that of other peer companies using similar measures. In addition, we believe that Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Earnings per Share, Free Cash Flow, Total Financial Debt, Total Net Financial Debt, and Total Net Financial Debt to Adjusted EBITDA ratio are frequently used by investors and other interested parties in the evaluation of issuers, many of which also present Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Earnings per Share, Free Cash Flow, Total Financial Debt, Total Net Financial Debt, and Total Net Financial Debt to Adjusted EBITDA ratio when reporting their results in an effort to facilitate an understanding of their operating and financial results and liquidity. Management supplements GAAP results with non-GAAP financial measures to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone.

Adjusted EBITDA: We define Adjusted EBITDA as net income (loss) before interest, taxes, depreciation and amortization, as further adjusted to exclude certain non-cash, non-recurring and other adjustment items.

Adjusted EBITDA Margin: We define Adjusted EBITDA Margin as Adjusted EBITDA, defined above, divided by Net Service Revenues.

Adjusted Net Income: We define Adjusted Net Income as net income (loss) including interest and depreciation, and excluding other items used to calculate Adjusted EBITDA and further adjusted for the tax effect of these exclusions and the removal of the discrete tax items.

Adjusted Earnings per Share: We define Adjusted Earnings per Share as Adjusted Net Income divided by the weighted average number of common shares outstanding for the period.

Free Cash Flow: We define Free Cash Flow as cash flows from operating activities less capital expenditures, net of proceeds from the sale of property and equipment.

Total Financial Debt: We define Total Financial Debt as total long-term debt, net of original issue discount, and finance/capital lease obligations.

Total Net Financial Debt: We define Total Net Financial Debt as Total Financial Debt minus total cash and cash equivalents.

Total Net Financial Debt to Adjusted EBITDA ratio: We define Total Net Financial Debt to Adjusted EBITDA ratio as Total Net Financial Debt divided by the trailing twelve month Adjusted EBITDA.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Earnings per Share, Free Cash Flow, Total Financial Debt, Total Net Financial Debt, and Total Net Financial Debt to Adjusted EBITDA ratio are not recognized terms under GAAP and should not be considered as an alternative to net income (loss) or the ratio of net income (loss) to net revenue as a measure of financial performance, cash flows provided by operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. Additionally, these measures are not intended to be a measure of free cash flow available for management’s discretionary use as they do not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The presentations of these measures have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company.

|

BrightView Holdings, Inc. |

||||||||

|

Consolidated Balance Sheets |

||||||||

|

(Unaudited) |

||||||||

|

(in millions)* |

|

December 31, 2020 |

|

|

September 30, 2020 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

81.6 |

|

|

$ |

157.1 |

|

|

Accounts receivable, net |

|

|

346.2 |

|

|

|

319.2 |

|

|

Unbilled revenue |

|

|

74.6 |

|

|

|

94.6 |

|

|

Other current assets |

|

|

65.2 |

|

|

|

62.2 |

|

|

Total current assets |

|

|

567.6 |

|

|

|

633.1 |

|

|

Property and equipment, net |

|

|

255.8 |

|

|

|

251.5 |

|

|

Intangible assets, net |

|

|

223.9 |

|

|

|

221.3 |

|

|

Goodwill |

|

|

1,900.3 |

|

|

|

1,859.3 |

|

|

Operating lease assets |

|

|

64.1 |

|

|

|

58.8 |

|

|

Other assets |

|

|

45.5 |

|

|

|

47.0 |

|

|

Total assets |

|

$ |

3,057.2 |

|

|

$ |

3,071.0 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

117.4 |

|

|

$ |

116.8 |

|

|

Current portion of long-term debt |

|

|

10.4 |

|

|

|

12.3 |

|

|

Deferred revenue |

|

|

67.1 |

|

|

|

57.1 |

|

|

Current portion of self-insurance reserves |

|

|

49.1 |

|

|

|

48.4 |

|

|

Accrued expenses and other current liabilities |

|

|

168.3 |

|

|

|

197.2 |

|

|

Current portion of operating lease liabilities |

|

|

20.0 |

|

|

|

18.3 |

|

|

Total current liabilities |

|

|

432.3 |

|

|

|

450.1 |

|

|

Long-term debt, net |

|

|

1,125.8 |

|

|

|

1,127.5 |

|

|

Deferred tax liabilities |

|

|

36.2 |

|

|

|

38.9 |

|

|

Self-insurance reserves |

|

|

100.2 |

|

|

|

102.7 |

|

|

Long-term operating lease liabilities |

|

|

51.0 |

|

|

|

47.5 |

|

|

Other liabilities |

|

|

43.0 |

|

|

|

32.8 |

|

|

Total liabilities |

|

|

1,788.5 |

|

|

|

1,799.5 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; 50,000,000 shares authorized; no shares issued or outstanding as of December 31, 2020 and September 30, 2020 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value; 500,000,000 shares authorized; 105,100,000 and 104,900,000 shares issued and outstanding as of December 31, 2020 and September 30, 2020, respectively |

|

|

1.1 |

|

|

|

1.0 |

|

|

Treasury stock, at cost; 237,000 and 91,000 shares as of December 31, 2020 and September 30, 2020, respectively |

|

|

(3.6 |

) |

|

|

(2.5 |

) |

|

Additional paid-in-capital |

|

|

1,474.4 |

|

|

|

1,467.8 |

|

|

Accumulated deficit |

|

|

(199.9 |

) |

|

|

(187.9 |

) |

|

Accumulated other comprehensive loss |

|

|

(3.3 |

) |

|

|

(6.9 |

) |

|

Total stockholders’ equity |

|

|

1,268.7 |

|

|

|

1,271.5 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

3,057.2 |

|

|

$ |

3,071.0 |

|

|

(*) |

Amounts may not total due to rounding. |

|

BrightView Holdings, Inc. |

||||||||

|

Consolidated Statements of Operations |

||||||||

|

(Unaudited) |

||||||||

|

|

|

Three Months Ended December 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

(in millions)* |

|

|

|

|

|

|

|

|

|

Net service revenues |

|

$ |

554.4 |

|

|

$ |

570.7 |

|

|

Cost of services provided |

|

|

420.8 |

|

|

|

427.7 |

|

|

Gross profit |

|

|

133.6 |

|

|

|

143.0 |

|

|

Selling, general and administrative expense |

|

|

123.3 |

|

|

|

130.3 |

|

|

Amortization expense |

|

|

13.9 |

|

|

|

13.5 |

|

|

(Loss) from operations |

|

|

(3.6 |

) |

|

|

(0.8 |

) |

|

Other income |

|

|

1.4 |

|

|

|

0.7 |

|

|

Interest expense |

|

|

13.6 |

|

|

|

17.4 |

|

|

(Loss) before income taxes |

|

|

(15.8 |

) |

|

|

(17.5 |

) |

|

Income tax benefit |

|

|

3.8 |

|

|

|

4.9 |

|

|

Net (loss) |

|

$ |

(12.0 |

) |

|

$ |

(12.6 |

) |

|

(Loss) per share: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

|

BrightView Holdings, Inc. |

||||||||

|

Segment Reporting |

||||||||

|

(Unaudited) |

||||||||

|

|

|

Three Months Ended December 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

(in millions)* |

|

|

|

|

|

|

|

|

|

Maintenance Services |

|

$ |

418.0 |

|

|

$ |

418.9 |

|

|

Development Services |

|

|

137.4 |

|

|

|

152.8 |

|

|

Eliminations |

|

|

(1.0 |

) |

|

|

(1.0 |

) |

|

Net Service Revenues |

|

$ |

554.4 |

|

|

$ |

570.7 |

|

|

Maintenance Services |

|

$ |

49.6 |

|

|

$ |

47.7 |

|

|

Development Services |

|

|

17.1 |

|

|

|

19.1 |

|

|

Corporate |

|

|

(14.3 |

) |

|

|

(15.1 |

) |

|

Adjusted EBITDA |

|

$ |

52.4 |

|

|

$ |

51.7 |

|

|

Maintenance Services |

|

$ |

8.9 |

|

|

$ |

11.7 |

|

|

Development Services |

|

|

0.3 |

|

|

|

2.0 |

|

|

Corporate |

|

|

0.5 |

|

|

|

0.8 |

|

|

Capital Expenditures |

|

$ |

9.7 |

|

|

$ |

14.5 |

|

|

(*) |

Amounts may not total due to rounding. |

|

BrightView Holdings, Inc. |

||||||||

|

Consolidated Statements of Cash Flows |

||||||||

|

(Unaudited) |

||||||||

|

|

|

Three Months Ended December 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

(in millions)* |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net (loss) |

|

$ |

(12.0 |

) |

|

$ |

(12.6 |

) |

|

Adjustments to reconcile net (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

21.6 |

|

|

|

20.2 |

|

|

Amortization of intangible assets |

|

|

13.9 |

|

|

|

13.5 |

|

|

Amortization of financing costs and original issue discount |

|

|

0.9 |

|

|

|

0.9 |

|

|

Deferred taxes |

|

|

(4.1 |

) |

|

|

(4.9 |

) |

|

Equity-based compensation |

|

|

4.9 |

|

|

|

8.2 |

|

|

Realized loss on hedges |

|

|

5.3 |

|

|

|

2.7 |

|

|

Other non-cash activities, net |

|

|

0.5 |

|

|

|

(0.4 |

) |

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(23.0 |

) |

|

|

(29.6 |

) |

|

Unbilled and deferred revenue |

|

|

32.3 |

|

|

|

40.3 |

|

|

Other operating assets |

|

|

2.4 |

|

|

|

(14.1 |

) |

|

Accounts payable and other operating liabilities |

|

|

(37.6 |

) |

|

|

(16.9 |

) |

|

Net cash provided by operating activities |

|

|

5.1 |

|

|

|

7.3 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(9.7 |

) |

|

|

(14.5 |

) |

|

Proceeds from sale of property and equipment |

|

|

0.6 |

|

|

|

1.0 |

|

|

Business acquisitions, net of cash acquired |

|

|

(62.2 |

) |

|

|

(18.4 |

) |

|

Other investing activities, net |

|

|

(0.1 |

) |

|

|

— |

|

|

Net cash used in investing activities |

|

|

(71.4 |

) |

|

|

(31.9 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Repayments of finance lease obligations |

|

|

(4.0 |

) |

|

|

(1.5 |

) |

|

Repayments of term loan |

|

|

(2.6 |

) |

|

|

(2.6 |

) |

|

Repayments of receivables financing agreement |

|

|

— |

|

|

|

(10.0 |

) |

|

Proceeds from receivables financing agreement |

|

|

— |

|

|

|

10.0 |

|

|

Proceeds from issuance of common stock, net of share issuance costs |

|

|

0.5 |

|

|

|

0.6 |

|

|

Repurchase of common stock and distributions |

|

|

(1.1 |

) |

|

|

(0.7 |

) |

|

Other financing activities, net |

|

|

(2.0 |

) |

|

|

— |

|

|

Net cash used in financing activities |

|

|

(9.2 |

) |

|

|

(4.2 |

) |

|

Net change in cash and cash equivalents |

|

|

(75.5 |

) |

|

|

(28.8 |

) |

|

Cash and cash equivalents, beginning of period |

|

|

157.1 |

|

|

|

39.1 |

|

|

Cash and cash equivalents, end of period |

|

$ |

81.6 |

|

|

$ |

10.3 |

|

|

(*) |

Amounts may not total due to rounding. |

|

BrightView Holdings, Inc. |

||||||||

|

Reconciliation of GAAP to Non-GAAP Financial Measures |

||||||||

|

(Unaudited) |

||||||||

|

|

|

Three Months Ended December 31, |

|

|||||

|

(in millions)* |

|

2020 |

|

|

2019 |

|

||

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(12.0 |

) |

|

$ |

(12.6 |

) |

|

Plus: |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

13.6 |

|

|

|

17.4 |

|

|

Income tax (benefit) |

|

|

(3.8 |

) |

|

|

(4.9 |

) |

|

Depreciation expense |

|

|

21.6 |

|

|

|

20.2 |

|

|

Amortization expense |

|

|

13.9 |

|

|

|

13.5 |

|

|

Establish public company financial reporting compliance (a) |

|

|

— |

|

|

|

0.9 |

|

|

Business transformation and integration costs (b) |

|

|

6.4 |

|

|

|

8.3 |

|

|

Offering-related expenses (c) |

|

|

0.2 |

|

|

|

0.4 |

|

|

Equity-based compensation (d) |

|

|

5.0 |

|

|

|

8.5 |

|

|

COVID-19 related expenses (e) |

|

|

7.5 |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

52.4 |

|

|

$ |

51.7 |

|

|

Adjusted Net Income |

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(12.0 |

) |

|

$ |

(12.6 |

) |

|

Plus: |

|

|

|

|

|

|

|

|

|

Amortization expense |

|

|

13.9 |

|

|

|

13.5 |

|

|

Establish public company financial reporting compliance (a) |

|

|

— |

|

|

|

0.9 |

|

|

Business transformation and integration costs (b) |

|

|

6.4 |

|

|

|

8.3 |

|

|

Offering-related expenses (c) |

|

|

0.2 |

|

|

|

0.4 |

|

|

Equity-based compensation (d) |

|

|

5.0 |

|

|

|

8.5 |

|

|

COVID-19 related expenses (e) |

|

|

7.5 |

|

|

|

— |

|

|

Income tax adjustment (f) |

|

|

(8.1 |

) |

|

|

(8.4 |

) |

|

Adjusted Net Income |

|

$ |

12.9 |

|

|

$ |

10.6 |

|

|

Free Cash Flow |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

|

$ |

5.1 |

|

|

$ |

7.3 |

|

|

Minus: |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

9.7 |

|

|

|

14.5 |

|

|

Plus: |

|

|

|

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

0.6 |

|

|

|

1.0 |

|

|

Free Cash Flow |

|

$ |

(4.0 |

) |

|

$ |

(6.2 |

) |

|

(*) |

Amounts may not total due to rounding. |

BrightView Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

|

(a)

|

Represents costs incurred to establish public company financial reporting compliance, including costs to comply with the requirements of Sarbanes-Oxley and the accelerated adoption of the revenue recognition standard (ASC 606 – Revenue from Contracts with Customers), and other miscellaneous costs. |

|

|

(b) |

Business transformation and integration costs consist of (i) severance and related costs; (ii) vehicle fleet rebranding costs; (iii) business integration costs and (iv) information technology infrastructure, transformation costs, and other. |

|

|

|

Three Months Ended December 31, |

|||||

|

(in millions)* |

|

2020 |

|

|

2019 |

||

|

Severance and related costs |

|

$ |

0.2 |

|

|

$ |

0.2 |

|

Business integration |

|

|

3.6 |

|

|

|

5.4 |

|

IT infrastructure, transformation, and other |

|

|

2.6 |

|

|

|

2.7 |

|

Business transformation and integration costs |

|

$ |

6.4 |

|

|

$ |

8.3 |

|

(c) |

Represents expenses incurred for IPO related litigation and subsequent registration statements. |

|

|

(d) |

Represents equity-based compensation expense and related taxes recognized for equity incentive plans outstanding. |

|

|

(e) |

Represents expenses related to the Company’s response to the COVID-19 pandemic, principally temporary and incremental salary and related expenses, personal protective equipment and cleaning and supply purchases, and other. |

|

|

(f) |

Represents the tax effect of pre-tax items excluded from Adjusted Net Income and the removal of the applicable discrete tax items, which collectively result in a reduction of income tax. The tax effect of pre-tax items excluded from Adjusted Net Income is computed using the statutory rate related to the jurisdiction that was impacted by the adjustment after taking into account the impact of permanent differences and valuation allowances. Discrete tax items include changes in laws or rates, changes in uncertain tax positions relating to prior years and changes in valuation allowances. |

|

|

|

Three Months Ended December 31, |

|||||

|

(in millions)* |

|

2020 |

|

|

2019 |

||

|

Tax impact of pre-tax income adjustments |

|

$ |

7.6 |

|

|

$ |

8.1 |

|

Discrete tax items |

|

|

0.5 |

|

|

|

0.3 |

|

Income tax adjustment |

|

$ |

8.1 |

|

|

$ |

8.4 |

|

Total Financial Debt and Total Financial Net Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)* |

|

December 31, 2020 |

|

|

December 31, 2019 |

|

|

September 30, 2020 |

|

|||

|

Long-term debt, net |

|

$ |

1,125.8 |

|

|

$ |

1,132.5 |

|

|

$ |

1,127.5 |

|

|

Plus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt |

|

|

10.4 |

|

|

|

10.4 |

|

|

|

12.3 |

|

|

Financing costs, net |

|

|

13.0 |

|

|

|

16.3 |

|

|

|

13.9 |

|

|

Present value of net minimum payment - finance lease obligations |

|

|

20.4 |

|

|

|

6.2 |

|

|

|

18.6 |

|

|

Total Financial Debt |

|

|

1,169.6 |

|

|

|

1,165.4 |

|

|

|

1,172.3 |

|

|

Less: Cash and cash equivalents |

|

|

(81.6 |

) |

|

|

(10.3 |

) |

|

|

(157.1 |

) |

|

Total Net Financial Debt |

|

$ |

1,088.0 |

|

|

$ |

1,155.1 |

|

|

$ |

1,015.2 |

|

|

Total Net Financial Debt to Adjusted EBITDA ratio |

|

4.0x |

|

|

3.8x |

|

|

3.7x |

|

|||

|

(*) |

Amounts may not total due to rounding. |

About BrightView:

BrightView (NYSE: BV), the nation’s largest commercial landscaper, proudly designs, creates, and maintains the best landscapes on Earth and provides the most efficient and comprehensive snow and ice removal services. With a dependable service commitment, BrightView brings brilliant landscapes to life at premier properties across the United States, including business parks and corporate offices, homeowners' associations, healthcare facilities, educational institutions, retail centers, resorts and theme parks, municipalities, golf courses, and sports venues. BrightView also serves as the Official Field Consultant to Major League Baseball. Through industry-leading best practices and sustainable solutions, BrightView is invested in taking care of our team members, engaging our clients, inspiring our communities, and preserving our planet. Visit www.BrightView.com and connect with us on X, Facebook, and LinkedIn.

For more information and/or permission to use BrightView images and assets, please send all media inquiries to [email protected]