BrightView Reports First Quarter Fiscal 2019 Results, Reaffirms Full Year Fiscal 2019 Guidance

BrightView Holdings, Inc. (NYSE: BV) (the “Company” or “BrightView”), the leading commercial landscaping services company in the United States, today reported unaudited results for the first quarter ended December 31, 2018.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190207005088/en/

(Graphic: Business Wire)

First Quarter Fiscal 2019 Highlights

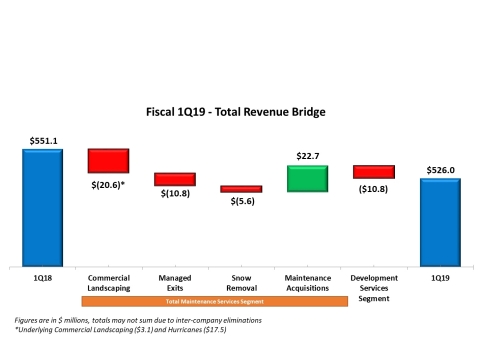

- Total Revenues for the quarter totaled $526.0 million, a 4.6% decline versus the prior year quarter, with 3.5% lower Maintenance Services Segment revenues and 7.5% lower Development Services Segment revenues;

- Net Loss of $8.8 million, or ($0.09) per share or net loss margin of 1.7%, compared to Net Income of $19.3 million, or $0.25 per share or net income margin of 3.5%, in the prior year quarter;

- Adjusted EBITDA of $50.1 million, or 24.5% below the prior year quarter, with an Adjusted EBITDA margin of 9.5%;

- Adjusted Net Income of $10.4 million, or $0.10 per share, compared to Adjusted Net Income of $13.4 million, or $0.17 per share, in the prior year quarter.

“Our financial results reflect the challenging prior-year hurricane comparisons, our strategic Managed Exit initiative and other operating conditions that we highlighted in our guidance on our November 2018 earnings conference call, as well as a slow start to the season for our snow removal services. Since we planned for these seasonal and episodic factors, we are not changing our outlook for full fiscal 2019. Our net new sales, which will benefit the upcoming ‘green’ maintenance season, are the highest they have been in three years; our development project bookings are ahead of last year’s pace and our strong-on-strong acquisition strategy already has added three companies with enough expected revenue impact to reach our full year fiscal 2019 target of $75 million,” said Andrew Masterman, BrightView President and Chief Executive Officer. “As we move through the year we will build on our best-in-class operating foundation by executing against our key growth drivers of maximizing existing customer relationships, adding new customers to our portfolio, and expanding our national footprint.”

Unless indicated otherwise, the information in this release has been adjusted to give effect to a 2.33839-for-one reverse stock split of the Company’s common stock effected on June 8, 2018. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Free Cash Flow and Adjusted Earnings per Share are non-GAAP measures. Refer to the “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” sections for more information.

Fiscal 2019 Results – Total BrightView

| Total BrightView - Operating Highlights | ||||||||||

| Three Months Ended December 31, | ||||||||||

| ($ in millions, except per share figures) | 2018 | 2017 | Change | |||||||

| Revenue | $ | 526.0 | $ | 551.1 | (4.6%) | |||||

| Net (loss) income | $ | (8.8 | ) | $ | 19.3 | -145.7% | ||||

| Adjusted EBITDA | $ | 50.1 | $ | 66.4 | (24.5%) | |||||

| Adjusted EBITDA Margin | 9.5 | % | 12.1 | % | -260 bps | |||||

| Adjusted Net Income | $ | 10.4 | $ | 13.4 | (22.4%) | |||||

| Earnings per Share, GAAP | $ | (0.09 | ) | $ | 0.25 | -136.0% | ||||

| Earnings per Share, Adjusted | $ | 0.10 | $ | 0.17 | (41.6%) | |||||

For the first quarter fiscal 2019, total revenue decreased 4.6% to $526.0 million due to a decline in the Maintenance Services Segment and Development Services Segment revenue. Total Adjusted EBITDA declined 24.5% driven by decreases in the Maintenance Services Segment, due to hurricane and snow removal comparisons, and the Development Services Segment Adjusted EBITDA, due mostly to comparisons with large project work in the prior year, as discussed further below.

Fiscal 2019 Results – Segments

| Maintenance Services - Operating Highlights | ||||||||||

| Three Months Ended December 31, | ||||||||||

| ($ in millions) | 2018 | 2017 | Change | |||||||

| Landscape Maintenance | $ | 344.6 | $ | 353.1 | (2.4%) | |||||

| Snow Removal | $ | 48.0 | $ | 53.6 | (10.5%) | |||||

| Total Revenue | $ | 392.5 | $ | 406.7 | (3.5%) | |||||

| Adjusted EBITDA | $ | 48.7 | $ | 60.6 | (19.6%) | |||||

| Adjusted EBITDA Margin | 12.4 | % | 14.9 | % | -250 bps | |||||

| Capital Expenditures | $ | 11.1 | $ | 6.7 | 66.3% | |||||

For the first quarter fiscal 2019, revenue in the Maintenance Services Segment decreased 3.5% to $392.5 million. Landscape Maintenance Services revenue decreased 2.4%. Acquisitions added 6.4% but were partially offset by an 8.9% negative revenue contribution from commercial landscaping. Within this result, was a difficult comparison with the revenue related to Hurricane Irma and Maria clean-up, the final quarterly impact from the prior-year turnover of national accounts, and lower revenue due to Managed Exits as the Company strategically reduced the number of less profitable accounts established in previous years. Snow removal services revenue decreased 10.5% due to lower year-over-year snowfall in key geographies.

Adjusted EBITDA for the Maintenance Services Segment in the quarter decreased 19.6% to $48.7 million, with the Adjusted EBITDA margin decreasing 250 basis points versus the prior year quarter. The decline in segment profitability was mainly a result of higher-margin hurricane clean-up activity in the first quarter of fiscal 2018 and a decline in the contribution from snow removal services due to timing and below average snowfall during the quarter compared to the prior year quarter.

| Development Services - Operating Highlights | ||||||||||

| Three Months Ended December 31, | ||||||||||

| ($ in millions) | 2018 | 2017 | Change | |||||||

| Revenue | $ | 134.4 | $ | 145.2 | (7.5%) | |||||

| Adjusted EBITDA | $ | 17.0 | $ | 20.5 | (16.8%) | |||||

| Adjusted EBITDA Margin | 12.7 | % | 14.1 | % | -140 bps | |||||

| Capital Expenditures | $ | 3.2 | $ | 0.9 | 250.6% | |||||

Revenues for the Development Services Segment decreased 7.5% to $134.4 million for the first quarter fiscal 2019. Project revenue derived from Maintenance Services acquisitions contributed to offset a comparison against the prior year period due to timing of work performed on certain large projects.

Adjusted EBITDA for the Development Services Segment decreased 16.8% to $17.0 million in the quarter, negatively affected by the decrease in net revenue described above, coupled with an increase in costs related to timing of work performed.

| Total BrightView Cash Flow Metrics | ||||||||||

| Three Months Ended December 31, | ||||||||||

| ($ in millions) | 2018 | 2017 | Change | |||||||

| Cash Provided by Operating Activities | $ | 6.4 | $ | 82.5 | (92.2%) | |||||

| Adjusted Free Cash Flow | $ | (9.1 | ) | $ | 75.0 | (112.1%) | ||||

| Capital Expenditures | $ | 17.3 | $ | 29.8 | (41.8%) | |||||

Net cash provided by operating activities for the quarter ended December 31, 2018 was $6.4 million, compared to $82.5 million for the prior year. Adjusted Free Cash Flow for the quarter ended December 31, 2018 was cash used of $9.1 million, a decrease in cash generation of $84.1 million over the prior year. The decreases are reflective of lower working capital in the quarter primarily driven by timing of payments of accounts payables and other liabilities.

For the quarter ended December 31, 2018, capital expenditures were $17.3 million, compared with $29.8 million last year, driven by the purchase of legacy ValleyCrest facilities for $21.6 million in the prior year period. The Company also generated proceeds from the sale of property and equipment of $1.8 million and $0.7 million in the first quarters of fiscal 2019 and 2018, respectively. Net of the legacy asset purchase and the proceeds from the sale of property and equipment in each year, capital expenditures represented 3.0% and 1.4% of revenue in the first quarters of fiscal 2019 and 2018, respectively.

| Total BrightView Balance Sheet Metrics | ||||||||||

| ($ in millions) |

December 31, |

September 30, |

Change | |||||||

| Total Financial Debt1 | $ | 1,179.1 | $ | 1,184.4 | (0.4%) | |||||

| Total Cash & Equivalents | $ | 17.7 | $ | 35.2 | (49.7%) | |||||

| Total Net Financial Debt2 to Adjusted EBITDA ratio | 4.1x | 3.8x | -0.3x | |||||||

| 1Total Financial Debt includes total long-term debt, net of original issue discount, and capital lease obligations |

| 2Total Net Financial Debt equals Total Financial Debt minus Total Cash & Equivalents |

As of December 31, 2018, the Company’s Total Net Financial Debt was $1.161 billion, an increase of $12.2 million compared to $1.149 billion at the prior fiscal year end. Combined with lower Adjusted EBITDA generation for the quarter, the change in the Company’s net debt led to a Total Net Financial Debt to Adjusted EBITDA ratio of 4.1x as of December 31, 2018.

Recent Developments

Acquisition of Emerald Landscape Company, Inc.

On January 10, BrightView announced that it had acquired Emerald Landscape Company, Inc. (“Emerald”), a preeminent commercial landscaping company located in California’s Bay Area. Terms of the transaction were not disclosed.

Emerald specializes in commercial landscape maintenance, enhancement, tree care, turf management and irrigation services, employing more than 200 highly skilled team members. It operates branches in the key Bay Area markets of Livermore, Hayward, Concord, San Jose, Manteca, and Tracy.

Acquisition of Benchmark Landscapes

At the beginning of February, BrightView acquired Benchmark Landscapes, LLC (“Benchmark”), a leading commercial landscape service company in Central Texas. Terms of the transaction were not disclosed.

Benchmark offers a full suite of commercial landscaping solutions, including grounds management, landscape enhancement and arbor services. With over 200 employees, the company covers a service area from Austin to San Antonio, inclusive of the San Marcos and New Braunfels areas as well as Corpus Christi.

Conference Call Information

A conference call to discuss the first quarter fiscal 2019 financial results is scheduled for February 7, 2019, at 10 a.m. Eastern Standard Time. The U.S. toll free dial-in for the conference call is (877) 273-7124 and the international dial-in is (647) 689-5396. The conference passcode is 7383949. A live audio webcast of the conference call will be available on the Company’s investor website https://investor.brightview.com, where presentation materials will be posted prior to the call.

A telephone replay will be available shortly after the broadcast through February 14, 2019, by dialing 800-585-8367 from the U.S., and entering conference passcode 7383949. A replay of the audio webcast also will be archived on the Company’s investor website.

About BrightView:

BrightView (NYSE: BV), the nation’s largest commercial landscaper, proudly designs, creates, and maintains the best landscapes on Earth and provides the most efficient and comprehensive snow and ice removal services. With a dependable service commitment, BrightView brings brilliant landscapes to life at premier properties across the United States, including business parks and corporate offices, homeowners' associations, healthcare facilities, educational institutions, retail centers, resorts and theme parks, municipalities, golf courses, and sports venues. BrightView also serves as the Official Field Consultant to Major League Baseball. Through industry-leading best practices and sustainable solutions, BrightView is invested in taking care of our team members, engaging our clients, inspiring our communities, and preserving our planet. Visit www.BrightView.com and connect with us on X, Facebook, and LinkedIn.

For more information and/or permission to use BrightView images and assets, please send all media inquiries to [email protected]